« Return to 2013 September practicePRO 15th Issue Index

Could this happen to you? Getting duped on a bad cheque scam

In our newest effort to help Ontario lawyers appreciate where claims happen – and how to avoid them – we are pleased to introduce a new column to LAWPRO Magazine: “Could this happen to you?”

Lawyers have told us they like to hear about real scenarios and circumstances that resulted in malpractice claims. They say that this helps them better see how they can avoid making mistakes in their own practices. So, in this new column we will present the facts behind some of our actual claims files, and highlight the risk management lessons to help you avoid finding yourself in the same situation.

For our first “Could this happen to you?” column we are focusing on bad cheque frauds. When we deliver presentations to lawyers about how to recognize and avoid these frauds, we often hear “How could anybody actually fall for these schemes? I never would.”

Thanks to our efforts, we feel Ontario lawyers have greater “street smarts” when it comes to recognizing and avoiding bad cheque frauds. But, unfortunately, we are still seeing costly claims when lawyers occasionally fall for these frauds.

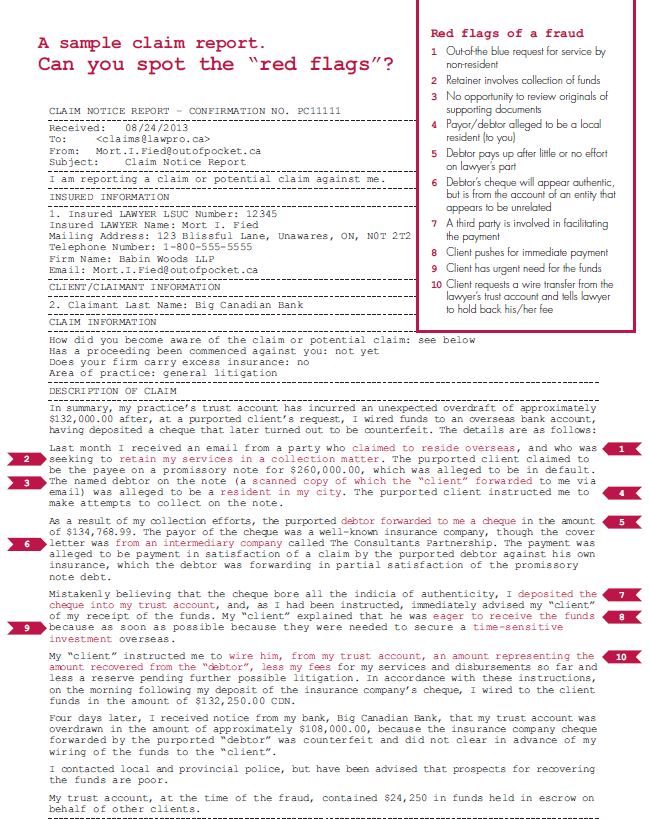

Reproduced on the next page is a sample of the report we get when a lawyer reports a claim using our online claim report form.

It is a classic textbook example of a bad cheque fraud where the lawyer was duped. Upon discovering these frauds, banks generally reverse the credit that was given on the deposit of the fake cheque.

Because the lawyer already disbursed funds in reliance on the fake cheque, this reversal removes trust funds belonging to other clients and/or leaves the lawyer’s trust account with a negative balance.

Please read the claim report. Can you spot the red flags? Could it happen to you?

On these bad cheque frauds we would generally afford coverage under the LAWPRO policy for the loss of the trust funds belonging to other clients. Any remaining overdraft would be the responsibility of the lawyer as the lawyer’s indebtedness to the bank would not fall within the coverage provisions of the LAWPRO policy, unless the lawyer complied with the coverage requirements of LAWPRO’s enhanced coverage for overdraft resulting from counterfeit certified cheques and bank drafts (Endorsement 7). Those requirements are:

(1)You must have waited at least eight business days following deposit of the instrument into your trust account before disbursing funds as instructed; or you must have received confirmation from either your financial institution or the drawee financial institution that the drawee financial institution has verified the validity of the instrument. As well, this confirmation must be documented in writing (whether by you or the financial institution) before payment instructions are given.

(2)The drawee financial institution indicated on the counterfeit certified cheque or counterfeit bank draft must be a Canadian financial institution, and the instrument must have been inspected and deposited by you, or a partner or employee of yours.

Note that the amount of coverage provided is subject to a sublimit of $500,000 per claim and in the aggregate (i.e. for all such claims reported by the lawyer or lawyers in the firm that year), inclusive of claim expenses, indemnity payments and/or costs of repairs. The coverage does not apply to retainer deposits, untransferred fees, or other amounts relating to legal fees, accounts or fee arrangements. As well, some limitations in deductible may apply.

The risk management lessons

Please don’t be complacent about these frauds. They are evolving and getting ever more sophisticated. Be vigilant! The supporting documents from the fraudsters – and the stories behind them – can be incredibly convincing. If a file you are handling seems like easy money, or otherwise too good to be true, think critically: Are there any details of the transaction that give you pause? Watch for the red flags that can indicate that an otherwise legitimate-looking matter is a fraud.

When in doubt, visit the AvoidAClaim.com blog and compare the potential client’s name and story to those of dozens of names known to be used by fraudsters. If you suspect you are acting on a matter that might be a fraud, call LAWPRO at 1-800-410-1013 or (416) 598-5899. We will talk you through the common fraud scenarios we are seeing and help you spot red flags that may indicate you are being duped. This will help you ask appropriate questions of your client to determine if the matter is legitimate or not. If the matter you are acting on turns out to be a fraud, we will work with you to prevent the fraud and minimize potential claims costs.

If you have been successfully duped, please immediately notify LAWPRO as there may be a claim against you.

If you have been targeted by any of these frauds, please forward any of the emails and supporting documents that you have received to [email protected].

More fraud prevention information and resources are available on the “practicePRO Fraud page” (practicepro.ca/fraud), including our “Fraud Fact Sheet,” a handy reference for lawyers and law firm staff that describes common frauds and the red flags that can help identify them.