Vacant Home Tax: Is your client buying or selling?

Several regions in Ontario have introduced or are contemplating the introduction of a vacant home/unit tax (VHT). The failure to file a declaration of occupancy status (“VHT declaration”) has led to complications for both sellers and buyers. If homeowners fail to submit the VHT declaration by the stipulated deadline, the property is presumed vacant. This forces owners to navigate the municipal complaint process to reverse the decision, potentially leaving the new owner to handle the VHT bill, penalties, and related charges. It’s crucial to remember that non-payment of property taxes, including the VHT, can result in a lien on the property.

Whose responsibility is it to file?

It’s advisable to consult your municipal property tax website to ascertain who is responsible for the VHT declaration for the preceding and current. This may vary depending on the deadline to file.

Lawyer representing the buyer

When acting on behalf of a buyer in a real estate property transaction, lawyers should consider requesting proof from the seller that they have filed the VHT declaration. As suggested by the City of Toronto, this evidence could be a copy of the filed VHT declaration and a statutory declaration affirming the accuracy of the VHT. If there are concerns, consider requesting a holdback equivalent to the estimated VHT amount.

Title Insurance

While title insurance may cover a VHT bill incurred prior to the purchase, it is often easier to request the necessary information upfront to avoid post-closing complications and potential harm to your professional reputation.

Lawyer representing the seller

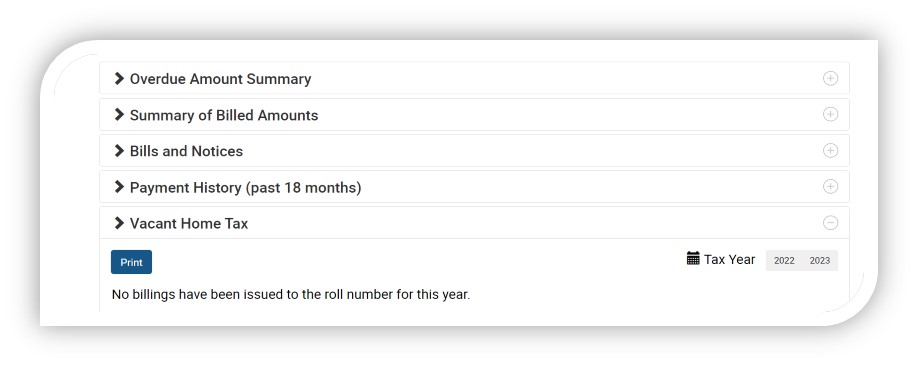

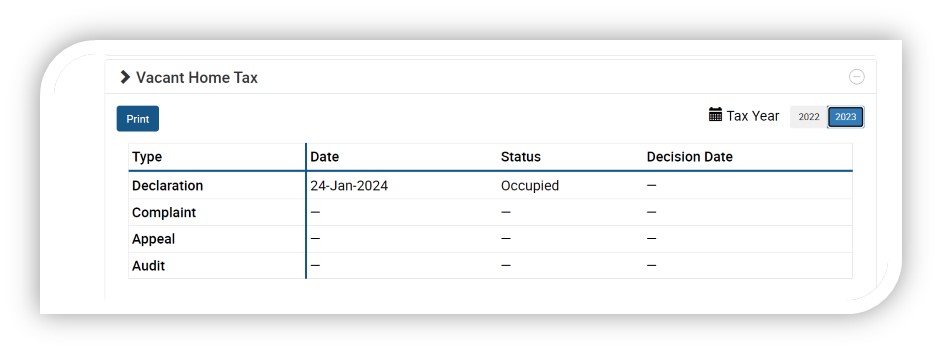

Inform your client early that you would like them to furnish a copy of the filed VHT declaration. It may take several years and numerous bill issuances before all homeowners realize the VHT declaration is an annual requirement. Additionally, homeowners planning to sell might be unaware of their obligation to file the VHT declaration, often assuming the new owner will handle it. If your client lacks a copy of the VHT declaration, they might be able to print one or furnish alternative proof of filing from their online tax portal. For instance, as a resident of the City of Toronto, I can easily print my declaration status from the City’s website. Below are two screenshots from my online portal.

Cooperation with the purchaser’s lawyer is encouraged to ensure a smooth transaction. Consider sharing information you obtain about the VHT declaration with the other lawyer.

In conclusion, the introduction of the VHT in Ontario has significant implications for both sellers and buyers in real estate transactions. The responsibility of filing the VHT declaration, the potential consequences of non-compliance, and the role of legal representatives in ensuring due diligence are all critical aspects to consider. As the landscape of property taxation evolves, it’s essential for real estate lawyers to stay informed and guide their clients effectively through these changes. This will ensure a smooth transaction process and safeguard the interests of all parties involved.

For information on municipalities that have introduced VHT, please visit this Government of Ontario webpage.